20

10/2020

Metal Processing Industry News: Tariff Impact and Market Dynamics

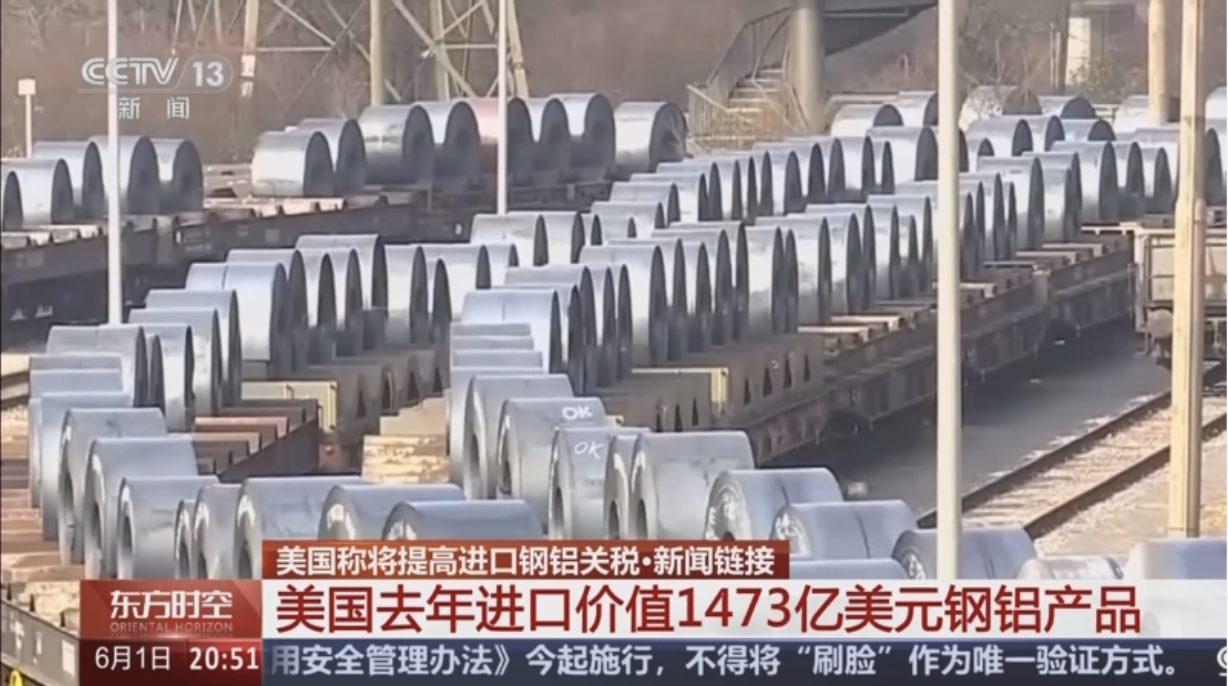

1. US Expands Steel and Aluminum Tariffs, Putting Pressure on Global Supply Chains

The US government recently imposed a 50% tariff on 407 steel and aluminum derivatives, primarily targeting China, the EU, and other regions. This move could push up global steel and aluminum prices by 15%-20% and accelerate the shift of supply chains to Southeast Asia and other regions.

2. Aluminum Prices Fluctuate, Demand Weakens

Affected by the off-season, domestic electrolytic aluminum inventories increased to 588,000 tons, and aluminum prices remained low (Shanghai aluminum at approximately 20,600 yuan/ton). However, long-term demand for new energy vehicles and lightweighting is expected to rebound in the fourth quarter.

3. Recommendations for Businesses

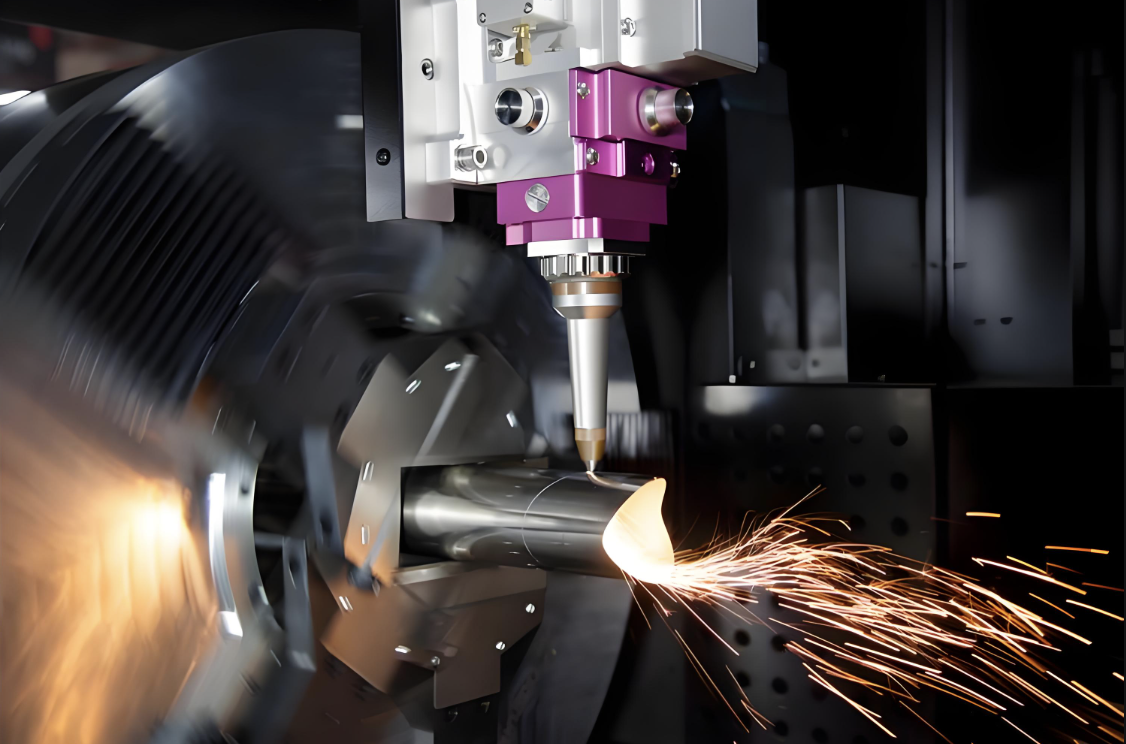

Processing Companies: Shift to high-value-added products (such as aerospace aluminum)

Traders: Optimize inventory and explore entrepot trade to circumvent tariffs

Trends to Watch: Recycled metals, smart production, and regionalized supply chains

Short-Term Outlook: Policy disruptions will exacerbate market volatility, but the approaching peak season may present structural opportunities.